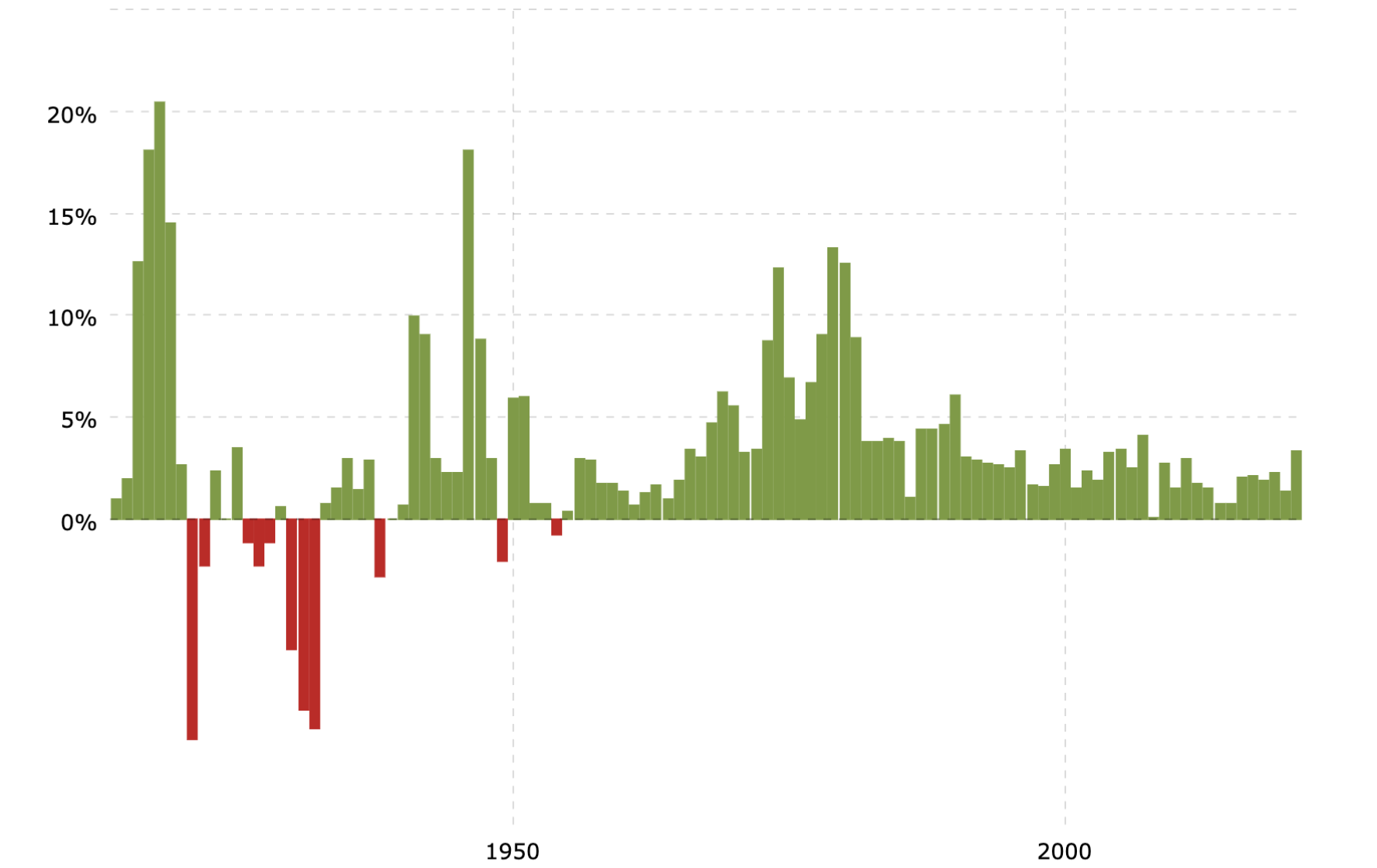

Inflation is a measure of how fast on average our goods and services are increasing over time. I was buying lamb chops from Costco at $5/lb last year but the price goes up to $6/lb this year. That’s one of the examples of inflation that I felt in my life.

What is inflation?

Inflation indicates a decrease in the purchasing power per unit of money, which basically means you get less stuff with the same amount of money. It’s caused by money supply growing faster than the rate of economic growth. There is just too much money on the market.

How is inflation calculated?

Inflation is often expressed as a percentage. There are many ways to calculate inflation in the economics field. One of the most popular ways is based on the Consumer Price Index (CPI). CPI is the weighted average of prices of popular goods and services that people depend upon, such as groceries, taxi, and medicines.

Let’s say the CPI goes from 200 last year to 210 this year. Then the inflation rate we get from it is (210 - 200) / 200 = 5%, means on average the general level of prices for consumers goes up by 5%.

Impacts on economy

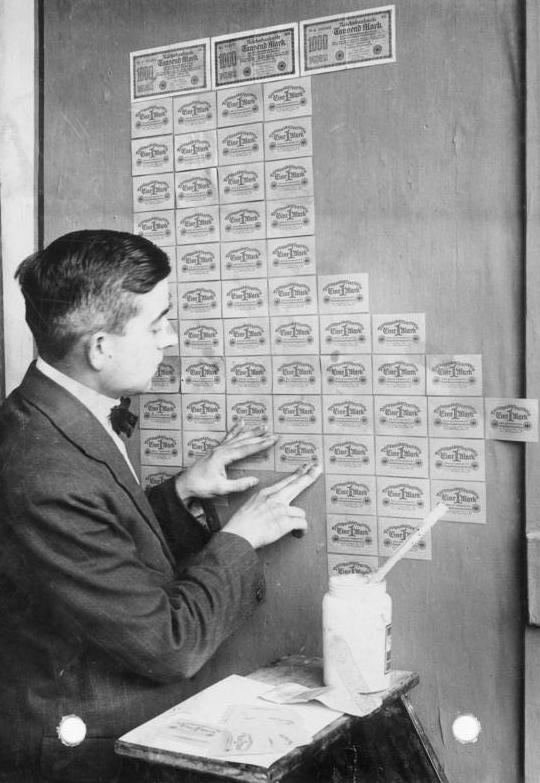

Every coin has two sides. Inflation affects economies in both positive and negative ways. Rapid inflation would lead to shortage of goods, as consumers would begin hoarding out of concern that prices will get higher in the future. Extreme inflation could collapse the monetary system and destroy the economy.

Germany, 1923: banknotes had lost so much value that they were used as wallpaper.

Low inflation encourages loan and investment, as people expect to get good returns from these investments and avoid the loss of value of their money. Most countries prefer to keep a steady rate of inflation.

Inflation is usually controlled by monetary authorities of each country like central banks. U.S. has been trying to keep inflation at 2% per year.

How to deal with inflation

If you are like me several years ago, leaving all the money in banks to earn that mere 1% yearly interest, you are likely losing your money now. Assume at a steady 2% inflation rate, your money is losing 2% - 1% = 1% of its value.

Where should we put our money?

Real estate is a good option during inflation. The value of the property is going to rise with inflation. Also, it can generate rental income, which is also going to increase with inflation. Usually homebuyers can get good mortgage rates due to low interest rates due to high inflation.

Gold is another popular option during inflation. Just like real estate, The gold supply on the market is limited and not easy to rise rapidly. So its price will also go up with inflation.

Stocks and bonds are also good ways to invest. They are easy to buy and sell, especially nowadays with all kinds of trading websites and apps . But investors have to be careful and do their research to pick the right ones.